Much of the business world is consumed by and swimming in Big Data. Were you a casual observer you might even say that the majority of companies are now drowning in data. A considerable proportion of insiders in industries as diverse as financial services, mobile telephony and digital publishing has little to no idea which data are valuable or how to deploy them. The truth is in this in confusing world, where new vendors are popping up every day and there are few standards for measuring performance and return on investment, many marketers and proportionally more publishers are avoiding taking on the challenge of Big Data altogether.

| |

The purpose of this article is to present a broad brush on the state of ad tech – broadly defined as technology-, math- and data-enabled marketing services – an admittedly complex marketplace, but one that can make the challenge of taking on the Big Data challenge less formidable. Another purpose is to highlight the business models and strategies of four leading companies from quite different walks of life – in terms of how they serve clients and the business models they employ – that are helping to reduce the complexity of big data by presenting cohesive and integrated enterprise solutions for marketers and publishers.

Whose data is it anyway?

Given what we know, or don’t know, about audience and media fragmentation, the reality – for those serving the Big Data market for marketers and publishers — is that real data, effectively deployed and interpreted, make for real insight.

Few marketing department leaders are sufficiently numerate to know which data are useful and how best to deploy data, as well as the supporting math to understand the value they are creating or destroying for their shareholders. This unacceptable state of affairs prevails inside big marketers like retailers, consumer packaged goods companies and financial services companies. It also applies to traditional and digitally native publishers who are seeking to “own” their readers, listeners and viewers by better understanding what the data about their behaviors, intent and loyalty are trying to tell them. Finally, the imperative to understand the data and to do the math especially goes for advertising agencies and other intermediaries (such as by type of business), the many that are clinging to any perch they can as their business continues to decline.

Ad agencies in particular have much to loose, since there are few barriers to entry for vendors offering significant reach and scale, and that are seeking to control specific links of the industry’s value chain (see the four examples below). Gone are the simpler but inherently conflicted days when agency clients were able to rely on the same agency to spend their money and then tell them the results they created. Now, leading marketers[i] use between five and ten data, math and tech vendors, none of which is an agency holding-company subsidiary.

Agencies have always behaved as if their clients’ customer data were their own. But marketers nowadays are increasingly viewing data as an asset – to be owned, mined and leveraged to maintain an edge in serving certain core audiences. For marketers, publishers and ad agencies, the legal ownership of the data or right to access them is the ultimate form of control over how, when, where and why an audience is engaged. Since many marketers, and even more publishers, would prefer to outsource the complicated work of audience management, ownership is the missing link in a lot of audience data-management strategies at the moment.

Big Data: A crowded market

The data-ownership issue frames the current status quo among ad tech vendors: there are just a few players – first, second- and third-party data[ii] providers and integrators, as they are known – that matter. So they can bob and weave with their clients’ emerging needs, each has a strong entrepreneurial bend. Each member of this short list also knows how to take a disorganized corner of a growing market and make a real company out of the opportunity.

The many vendors who provide services to marketers, publishers, and their supply chain intermediaries form what is loosely called the digital advertising marketplace[iii]. Current estimates value this market at just under $60-billion for 2012. With such a bounty, it’s no surprise that there are as many vendors as there are. Terry Kawaja, founder of Luma Partners in the San Francisco Bay area, has identified several clusters of vendors. (Please see the footnoted link to a series of visual depictions of the display, video, social, mobile, gaming and commerce marketplaces).

That there are dozens if not hundreds of these vendors — virtually all of them with venture backing — has created a malaise for their industry, clients and for the state of Big Data as a decision-making tool. This presents a quandary for entrepreneurs looking to enter the market with their next great algorithm, data integration tool or attribution (what happened when money was invested) insight. The same goes for the potential investors that are seeking to organize the marketplace by rolling up a few of the most differentiated and successful vendors to present a more integrated and cohesive offering to publishers and marketers.

Whose data is it anyway?

Given what we know, or don’t know, about audience and media fragmentation, the reality – for those serving the Big Data market for marketers and publishers — is that real data, effectively deployed and interpreted, make for real insight.

Few marketing department leaders are sufficiently numerate to know which data are useful and how best to deploy data, as well as the supporting math to understand the value they are creating or destroying for their shareholders. This unacceptable state of affairs prevails inside big marketers like retailers, consumer packaged goods companies and financial services companies. It also applies to traditional and digitally native publishers who are seeking to “own” their readers, listeners and viewers by better understanding what the data about their behaviors, intent and loyalty are trying to tell them. Finally, the imperative to understand the data and to do the math especially goes for advertising agencies and other intermediaries (such as by type of business), the many that are clinging to any perch they can as their business continues to decline.

Ad agencies in particular have much to loose, since there are few barriers to entry for vendors offering significant reach and scale, and that are seeking to control specific links of the industry’s value chain (see the four examples below). Gone are the simpler but inherently conflicted days when agency clients were able to rely on the same agency to spend their money and then tell them the results they created. Now, leading marketers[i] use between five and ten data, math and tech vendors, none of which is an agency holding-company subsidiary.

Agencies have always behaved as if their clients’ customer data were their own. But marketers nowadays are increasingly viewing data as an asset – to be owned, mined and leveraged to maintain an edge in serving certain core audiences. For marketers, publishers and ad agencies, the legal ownership of the data or right to access them is the ultimate form of control over how, when, where and why an audience is engaged. Since many marketers, and even more publishers, would prefer to outsource the complicated work of audience management, ownership is the missing link in a lot of audience data-management strategies at the moment.

Big Data: A crowded market

The data-ownership issue frames the current status quo among ad tech vendors: there are just a few players – first, second- and third-party data[ii] providers and integrators, as they are known – that matter. So they can bob and weave with their clients’ emerging needs, each has a strong entrepreneurial bend. Each member of this short list also knows how to take a disorganized corner of a growing market and make a real company out of the opportunity.

The many vendors who provide services to marketers, publishers, and their supply chain intermediaries form what is loosely called the digital advertising marketplace[iii]. Current estimates value this market at just under $60-billion for 2012. With such a bounty, it’s no surprise that there are as many vendors as there are. Terry Kawaja, founder of Luma Partners in the San Francisco Bay area, has identified several clusters of vendors. (Please see the footnoted link to a series of visual depictions of the display, video, social, mobile, gaming and commerce marketplaces).

That there are dozens if not hundreds of these vendors — virtually all of them with venture backing — has created a malaise for their industry, clients and for the state of Big Data as a decision-making tool. This presents a quandary for entrepreneurs looking to enter the market with their next great algorithm, data integration tool or attribution (what happened when money was invested) insight. The same goes for the potential investors that are seeking to organize the marketplace by rolling up a few of the most differentiated and successful vendors to present a more integrated and cohesive offering to publishers and marketers.

One might ask why this marketplace has not become better organized. The fact is that few funds or strategic investors such as private equity firms are interested in markets with low barriers to entry, namely a market with the many venture-backed vendors and companies that look more like features than companies.

While many believe marketing has become the corporate flag-bearer for Big Data, marketing is not and should not be its only or best home. Marketing is responsible for extracting insights on audience behaviors and intent that clarify company-wide lines of business and brand financial forecasts. Finance is responsible for incorporating these insights into the sensitivity analyses that allow board members to understand the specific near- and longer-term effects of alternative investments in marketing – allowing the prioritization of marketing investment alongside others. Technology is responsible for making the best decisions on vendor selection based on performance.

In an ideal world, the triumvirate of marketing, finance and technology is creating substantially new ways for companies to deal with current competitive challenges and for adjusting audience campaigns and other elements of ad spend while more precisely tuning long-term forecasts for shareholders and establishing performance standards for data vendors and integrators. In the real world, marketing, finance and technology are not departments that typically speak the same language or even get along much of the time. Marketing has long been saddled by the judgment of finance and tech departments that, as the owner of the their company’s revenue, they are important but essentially are also a cumbersome and ultimately irrelevant cost center.

Long the bugbear for companies trying to efficiently sort fact and fiction come budget time, the marketing function has lately been going through a substantial transformation. Much of the transformation has been led by the availability of audience and consumer data, by marketing and computer scientists able to parse and understand those data in a meaningful way, and the technology and computing cycles available to generate these insights in real time. Finally, there is a new willingness by c-suites, boards and other business leaders to look at their businesses differently[iv]. Financial services, healthcare, retail and several of their supply-chain companies have particularly benefited from deeper and more consistent insights on audience and customer behavior, intent and loyalty, and have used Big Data to gain a sustainable competitive edge.

All this change and open-mindedness, though, comes at a price. For old business methods to give way to new, old-business practitioners need to be able to establish business processes, standards of practice and performance metrics. The goal for companies that have not moved to do so would be to create the triumvirate of marketing, finance and tech departments referred to above. Marketers want standard performance metrics used across all their marketing campaigns.

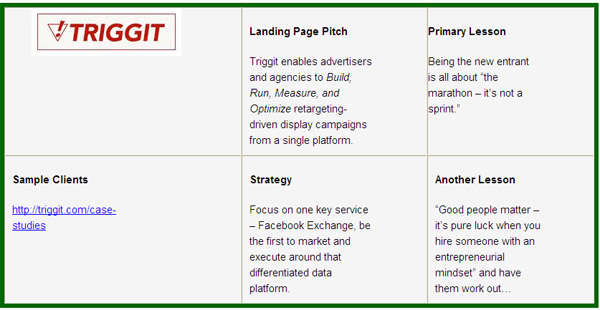

Publishers want to understand their real cost per thousand (CPM) pricing floor (above which they make a profit on the content they are selling to marketers). Agencies, who buy publishers’ content and attach their clients’ advertising to it, desire to maintain the preeminence of their creative and workflow management capabilities and the fee streams from them. As such, they will continue to resist any substantial changes to the way they do business. But in the $60B online advertising world, a figure now representing over half of all advertising budgets, substantial change is needed. Zach Coelius, the CEO of Triggit (profiled below), puts the opportunity succinctly: “If you can stem the dramatic fragmentation of media and audience that has accompanied the explosion of screens and other venues where consumers access content, you can monetize the dramatic amount of data made available to marketers from these many new channels.”

A real and measurable opportunity to reinvent marketing for advertisers and publishers

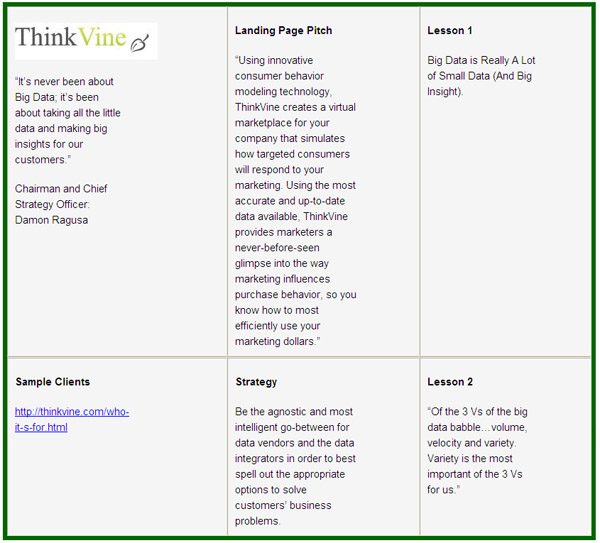

There are just a few data and insight vendors who have not become captive to the entrenched needs of old practitioners or to the fad, for some, of Big Data. One of them, ThinkVine, based in Cincinnati, Ohio, has deconstructed Big Data. Calling the glut of data available a “huge distraction”, ThinkVine’s Founder Damon Ragusa speaks to his customers (not “clients”) about Smart Data and Big Insights. ThinkVine’s customers have come to appreciate the hands-on nature of the business model and the fact that beyond the technology and math behind the offering, the basic operating principle is to remain source-agnostic and to understand the utility of the data.

Another leader is Triggit. Based in San Francisco, Triggit exclusively serves FaceBook Exchange, on one level a global social media publisher that has moved substantially toward not only owning its audience data, and is finding ever-better ways to use it to make advertising investment decisions for its advertiser clients.

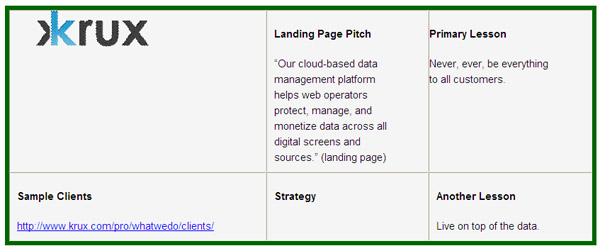

The third is Krux digital, another San Francisco, California company that has developed a self serve offering for enterprises and medium and smaller sized business as well.

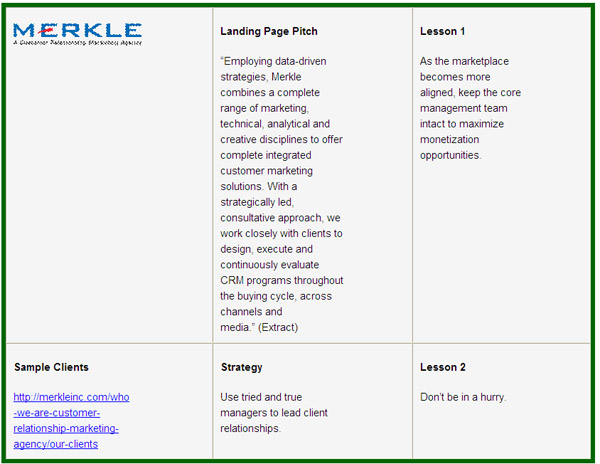

The fourth is Merkel, which is based in the Columbia, Maryland. With ambitions of building a substantial growth trajectory and better organizing data serving the ad-tech world, Merkel Group companies present clients with a potentially significant opportunity to cut through the data “Babel.” Coming from an offline data orientation but firmly rooted in the digital data world, Merkel can promise marketers and publishers that they will have a real opportunity to have the same conversation about how best to serve mutual customers’ interests. It would be safe to say that Merkle and the others we have highlighted have changed the game for many of their clients. Clients have realized tenfold and even greater returns on their capital investments in ad campaigns and have enjoyed significantly greater reliability from multi-year forecasts.

Each of the companies we have examined offers entrepreneurs, their clients and other business leaders important lessons, to paraphrase Animal Mother’s taunt (a character in Stanley Kubrick’s film Full Metal Jacket[v]) on how to stop just talking about data and “walk the talk.” As stated earlier in this article, the reality of media and audience fragmentation for entrepreneurs serving the big data market for marketers and publishers is that real data – effectively deployed and interpreted – makes for real insight.

While many believe marketing has become the corporate flag-bearer for Big Data, marketing is not and should not be its only or best home. Marketing is responsible for extracting insights on audience behaviors and intent that clarify company-wide lines of business and brand financial forecasts. Finance is responsible for incorporating these insights into the sensitivity analyses that allow board members to understand the specific near- and longer-term effects of alternative investments in marketing – allowing the prioritization of marketing investment alongside others. Technology is responsible for making the best decisions on vendor selection based on performance.

In an ideal world, the triumvirate of marketing, finance and technology is creating substantially new ways for companies to deal with current competitive challenges and for adjusting audience campaigns and other elements of ad spend while more precisely tuning long-term forecasts for shareholders and establishing performance standards for data vendors and integrators. In the real world, marketing, finance and technology are not departments that typically speak the same language or even get along much of the time. Marketing has long been saddled by the judgment of finance and tech departments that, as the owner of the their company’s revenue, they are important but essentially are also a cumbersome and ultimately irrelevant cost center.

Long the bugbear for companies trying to efficiently sort fact and fiction come budget time, the marketing function has lately been going through a substantial transformation. Much of the transformation has been led by the availability of audience and consumer data, by marketing and computer scientists able to parse and understand those data in a meaningful way, and the technology and computing cycles available to generate these insights in real time. Finally, there is a new willingness by c-suites, boards and other business leaders to look at their businesses differently[iv]. Financial services, healthcare, retail and several of their supply-chain companies have particularly benefited from deeper and more consistent insights on audience and customer behavior, intent and loyalty, and have used Big Data to gain a sustainable competitive edge.

All this change and open-mindedness, though, comes at a price. For old business methods to give way to new, old-business practitioners need to be able to establish business processes, standards of practice and performance metrics. The goal for companies that have not moved to do so would be to create the triumvirate of marketing, finance and tech departments referred to above. Marketers want standard performance metrics used across all their marketing campaigns.

Publishers want to understand their real cost per thousand (CPM) pricing floor (above which they make a profit on the content they are selling to marketers). Agencies, who buy publishers’ content and attach their clients’ advertising to it, desire to maintain the preeminence of their creative and workflow management capabilities and the fee streams from them. As such, they will continue to resist any substantial changes to the way they do business. But in the $60B online advertising world, a figure now representing over half of all advertising budgets, substantial change is needed. Zach Coelius, the CEO of Triggit (profiled below), puts the opportunity succinctly: “If you can stem the dramatic fragmentation of media and audience that has accompanied the explosion of screens and other venues where consumers access content, you can monetize the dramatic amount of data made available to marketers from these many new channels.”

A real and measurable opportunity to reinvent marketing for advertisers and publishers

There are just a few data and insight vendors who have not become captive to the entrenched needs of old practitioners or to the fad, for some, of Big Data. One of them, ThinkVine, based in Cincinnati, Ohio, has deconstructed Big Data. Calling the glut of data available a “huge distraction”, ThinkVine’s Founder Damon Ragusa speaks to his customers (not “clients”) about Smart Data and Big Insights. ThinkVine’s customers have come to appreciate the hands-on nature of the business model and the fact that beyond the technology and math behind the offering, the basic operating principle is to remain source-agnostic and to understand the utility of the data.

Another leader is Triggit. Based in San Francisco, Triggit exclusively serves FaceBook Exchange, on one level a global social media publisher that has moved substantially toward not only owning its audience data, and is finding ever-better ways to use it to make advertising investment decisions for its advertiser clients.

The third is Krux digital, another San Francisco, California company that has developed a self serve offering for enterprises and medium and smaller sized business as well.

The fourth is Merkel, which is based in the Columbia, Maryland. With ambitions of building a substantial growth trajectory and better organizing data serving the ad-tech world, Merkel Group companies present clients with a potentially significant opportunity to cut through the data “Babel.” Coming from an offline data orientation but firmly rooted in the digital data world, Merkel can promise marketers and publishers that they will have a real opportunity to have the same conversation about how best to serve mutual customers’ interests. It would be safe to say that Merkle and the others we have highlighted have changed the game for many of their clients. Clients have realized tenfold and even greater returns on their capital investments in ad campaigns and have enjoyed significantly greater reliability from multi-year forecasts.

Each of the companies we have examined offers entrepreneurs, their clients and other business leaders important lessons, to paraphrase Animal Mother’s taunt (a character in Stanley Kubrick’s film Full Metal Jacket[v]) on how to stop just talking about data and “walk the talk.” As stated earlier in this article, the reality of media and audience fragmentation for entrepreneurs serving the big data market for marketers and publishers is that real data – effectively deployed and interpreted – makes for real insight.

Four Data Entrepreneurs @ Two Lessons Each

Merkle is a $300-million private company that serves the customer relationship management (CRM) marketplace. In business since 1988, when CEO David Williams acquired the company, Merkle has promoted a management ethos to grow its business organically as much as possible and keep the widely respected management team intact. In 2008, the eminent Technology Crossover Ventures fund invested $75-million in the company. Currently, the company produces higher-than-median earnings (before non-cash items) and is attracting the interest of a few well-known private equity funds. These funds are interested in creating a more interesting marketing business model by building a multi-company roll up of smaller tech-enabled data leaders.

“We’re not there yet,” said Craig Dempster, CMO, when discussing the often crazy world of valuations among Merkle’s Big (digital) Data competitors. “It is possible to build the $5-$10-billion company [in this marketplace], though” because the traditional incumbents (IBM, Microsoft, Oracle and SAP, in particular) have failed to organize the market as they have done for accounting, manufacturing, human resources management and other central business processes.

While Merkle behaves like an integrated advertising agency holding company and presents itself as a CRM vendor, there is more going on within their unique business model. Among the companies profiled here, Merkle is the odd duck: it has much greater revenues, is better funded and more self-sufficient from a funding perspective, and is increasingly emerging as one of those able to better organize the display – traditional online advertising – and other marketing channels. As such, it is the source of a lot of buzz from the investor and competitor sides of the playing field.

ThinkVine is certainly an original thinker of the first order. ThinkVine’s intellectual property is based on its software-as-a-service application of agent-based modeling – a methodology for predicting consumer behaviors using artificial consumers in a closed universe. ThinkVine was first to market with a variant that could deliver near-perfect accuracy. But what has accounted for their greater-than 35 percent year-over-year growth rate? Simple to say, much harder to do: to establish a defensible and unique business model, ThinkVine has chosen to remain agnostic with respect to the data types and sources required to power their model.

As recently as two years ago, driven by venture capital investors’ quests for defendable assets, all the players in ad-tech were considering owning uniquely generated or originated data feeds that would more precisely describe or predict consumer behaviors in digital media.

As recently as two years ago, driven by venture capital investors’ quests for defendable assets, all the players in ad-tech were considering owning uniquely generated or originated data feeds that would more precisely describe or predict consumer behaviors in digital media.

On the subject of barriers to entry in the marketplace, Triggit’s CEO Zach Coelius is emphatic: the barriers are “much higher than you think” since “data and automated buying is the future for all media.” He is more pointed on the subject of the role of the ad agency: they “put themselves in a tricky position of protecting their own margins before their customers’ – this blocks entrepreneurship”. About questions relating to the future of his marketplace, Coelius is unequivocal: “How could I be worried. I bet on data, fragmentation and on real time. This means I also bet against other players’, business models and existing players like agencies.

The industry suffers from a lack of organization

“When does a company offer a ‘feature’ and when is it a real business?”[vi]

This is the question posed frequently by buy-side interests. In other words, is the offer unique and does it solve a business problem or is it a nice-to-have service or unique data source? Guess which gets the renewal.

Many of the business models used in digital marketing channels are going the way of their counterparts who have become dinosaurs in the offline world. Those choosing to ride out the truly giant structural changes in the marketing and broader business processes that have put digital marketing decision makers out front have chosen their futures. The market is about to be forced to organize by the vendors offering distinctive services that solve business problems for publishers and marketers simultaneously and by the strategic investors seeking to create a more efficient marketplace. The winners and losers will be sorted, as they often are when a market achieves catharsis, by how real they are.

Sorting this way will allow Big Data vendors and their funders to complete the process of changing how marketing and publishing businesses think.

Reprint from Ivey Business Journal

“When does a company offer a ‘feature’ and when is it a real business?”[vi]

This is the question posed frequently by buy-side interests. In other words, is the offer unique and does it solve a business problem or is it a nice-to-have service or unique data source? Guess which gets the renewal.

Many of the business models used in digital marketing channels are going the way of their counterparts who have become dinosaurs in the offline world. Those choosing to ride out the truly giant structural changes in the marketing and broader business processes that have put digital marketing decision makers out front have chosen their futures. The market is about to be forced to organize by the vendors offering distinctive services that solve business problems for publishers and marketers simultaneously and by the strategic investors seeking to create a more efficient marketplace. The winners and losers will be sorted, as they often are when a market achieves catharsis, by how real they are.

Sorting this way will allow Big Data vendors and their funders to complete the process of changing how marketing and publishing businesses think.

Reprint from Ivey Business Journal

Source: http://forbesindia.com/article/ivey/making-big-data-real/34977/0

No comments:

Post a Comment